Deduction Register

The deduction register lists summary information about deductions based on Deduction Code or who the deduction is payable to (usually used when tracking levies and garnishments). This report is available to systems with an active back office license and users with the payroll report permission.

1) Click Reporting on the main navigation bar and scroll to the Payroll Reports section.

2) Select Deduction Register to enter report criteria.

3) Select a Format type.

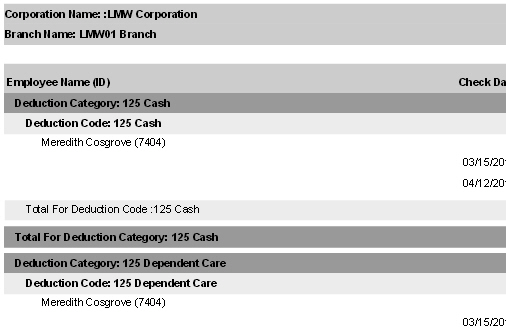

§ Deduction Register by Deduction Code: the register is grouped by corporation then branch then by deduction category and finally, by deduction code.

§ Deduction Register by Payable To: the register is grouped by corporation then branch then by deduction category and finally, by Payable To. NOTE: Payable To is assigned when adding a recurring deduction to an employee record. If the deduction code does not have a Payable To assigned, it will not show up on the report when this format is used.

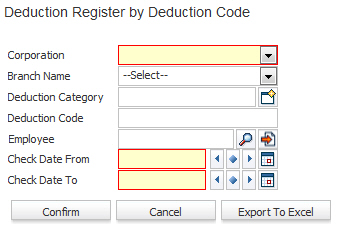

4) After selecting the format type the Deduction Register workflow will open for selection criteria input.

§ While updating the form, fields marked in red are required to complete the workflow. Click on the buttons to the right of certain fields to open a new window which will allow you to search and select options related to that specific field or choose a date.

§ Select a Corporation and a Check Date range.

§ Branch Name, Deduction Category, Deduction Code and Employee are all optional processing criteria and can be used to further define the deductions you want to see on the register.

5) After entering the criteria click Confirm to generate the report.

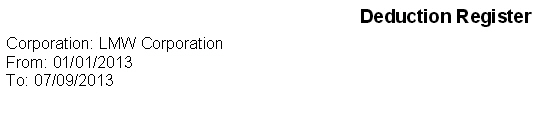

6) The report opens in a new window.

§ The header displays report name and criteria used to generate the report.

§ The data is then grouped and sorted by the format chosen in the beginning.

§ 7) Calculations in report:

§ Total for Deduction Code, Deduction Category, Branch, Corporation and then a Grand Total (all Corporations)

Full Report