The GL Export Process creates a file that can be imported into a third-party General Ledger system.

NOTE: The location where the file is created is determined in the Integration Settings segment of System Settings.

Creating an Export File

To run the GL Export Process:

Access Financials > Financial Processing > General Ledger Process.

Select the GL Export Process workflow (right side of screen).

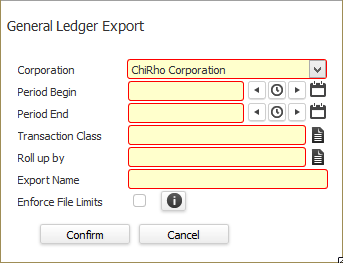

The following window displays:

In the Corporation field, select the Corporation for which you want to create an export file.

In the Period Begin and Period End fields, select the "From" and "To" dates that the system will use to search for transactions. Keep in mind that different journals use different criteria to determine a transaction date. The Sales and Cost of Sales Journals use the Posting Week Ending Date from the Timecard. The Billing Journal uses the Invoice Date. The Cash Receipts Journal uses the Payment Date. The Payroll Journal uses the Check Date. NOTE: Direct Deposit Advice uses either the advice date (if it has not been extracted) or the extract date (if it has been extracted).

Also, any transactions already exported (and not cleared) will NOT be picked up a second time by the export process. Thus, there is no harm with running the export for a period already exported. For example, if you ran the export process and then later, ran the costing process, the initial export run would not have produced the Costing journals. In this case, you can simply rerun the export for the same date range as before and the system will now produce the costing journals but not the regular payroll and billing journals (since they have already been exported).

In the Transaction Class field, select the type of information you want to see on the export file. Options are Job Category, PayBill Code or both. NOTE: This does not impact the actual transactions selected, but only whether the Job Category and/or PayBill Code is displayed on the export file.

In the Roll up by field, select the information you want to see on the export file. Options are None, Branch, Branch & Division or Region, Branch & Division. NOTE: This does not impact the actual transactions selected, but only whether the Branch, Division and/or Region is displayed on the export file.

In the Export Name field, enter a unique name for the export file. IMPORTANT - If the name matches the name of a file already exported, then the file already exported will be overwritten (or replaced) with the new file. Therefore, you should make sure that the name entered here is unique.

In the Enforce File Limits checkbox, place a check in the box if your third-party GL software requires a limited file size. A check in the box limits the file size to either 1000 rows or 2 mb (whichever comes first). If all of the transactions do not fit on a single file, additional files are created and appended with an incremental number (so that all filenames are unique). If the box is not selected, the system will include all transactions on a single file.

Once you are satisfied with your selections, click the Confirm button. The process is sent to the queue where the file is created in the background. The file now appears on the General Ledger Export Process Search Results grid (depending on the filtering criteria). In addition, all transactions are marked as "Exported" in the database, which prevents them from being exported again.

NOTE: If you need to clear the export setting (for example, if you accidentally delete a GL Export file, please have your liaison contact Bond Support.

Viewing Process Information

To view process information, simply click on the Process ID in the General Ledger Export Process Search Results grid.

The Summary segment displays:

Process ID, Status and Name

Submitted By, Date and Time

End Date and Time

The Diagnostics segment displays information and exceptions that came up during processing. For example, if you selected not to enforce a file size limit, a diagnostic message displays reminding you of the choice you made.

Viewing the Export File

The export file can be viewed in the directory selected in System Settings. The file has a .csv extension and can be opened by whatever program your operating system associates with comma-delimited files.

The export file has the following columns:

process_id: GL Export process ID

process_source: Journal Type (AR = Accounts Receivable, ARADJ = Accounts Receivable Adjustment, COS = Cost of Sales, PR = Payroll, SALES = Sales)

process_description: Journal Entry (e.g., Accounts Receivable, Sales Tax, Unbilled Sales, etc.). NOTE: This column also displays Bill Units or Pay Units if the measurement type is Units. It also indicates "Non-Payroll" when the Bill Only Flag is True and there are Pay Hours/Amounts to be reported.

journal_id: Reference to the Parent Record ID

journal_desc: Source transaction type (e.g., Direct Hire, Direct Hire Billing Adjustment, Timecard Invoice, etc.)

journal_tran_date: Document date for the source transaction.

tran_id: Reference to the Detailed record.

tran_post_date: Date source transaction was processed.

corporation

account: Transaction class. This can show Job Category, PayBill Code or both.

department: Roll-up option. This can show the Region and Branch or just the Branch (or nothing).

subaccount: Roll-up option. This shows the Division (if that option was selected on the General Ledger Export window).

record_id: ID of the number associated with the journal entry. The information displayed depends on the associated journal entry. For example, this may be an invoice number if this is an AR Adjustment. It might be a Timecard ID if this is a Payroll Expense.

debit_amt: Amount entered as a debit.

credit_amt: Amount entered as a credit.

General Information about Journals:

The AR Adjustment Journal contains the following (where the posting date of the transaction is within the date range selected):

Gross Adjustment amount from each posted AR Adjustment.

Total Discount amount from each posted AR Adjustment.

Total Sales Tax amount from each posted AR Adjustment.

The Cost of Sales Journal contains the following (where the posting date of the transaction is within the date range selected):

Total Pay hours from each posted Timecard.

Total Pay hours from each posted Timecard Billing Adjustment.

Total Pay amount from each posted Timecard.

Total Pay amount from each posted Timecard Billing Adjustment.

The Sales Journal contains the following (where the posting week end date/sales posting date of the transaction is within the date range selected):

Total Bill hours from each posted Timecard.

Total Bill hours from each posted Direct Hire Billing.

Total Bill hours from each posted Timecard Billing Adjustment.

Total Bill hours from each posted Direct Hire Billing Adjustment.

Total Bill amount from each posted Timecard.

Total Bill amount from each posted Direct Hire Billing.

Total Bill amount from each posted Timecard Billing Adjustment.

Total Bill amount from each posted Direct Hire Billing Adjustment.

The Billing AR Journal contains the following (where the invoice date of the transaction is within the date range selected):

Total Bill amount from each updated Timecard Invoice.

Total Bill amount from each updated Direct Hire Invoice.

Total Bill amount from each updated Timecard Billing Adjustment.

Total Bill amount from each updated Direct Hire Billing Adjustment.

The Payroll Journal Burden contains the actual burden amounts for the following (where the posting date of the timecard is within the date range selected):

FICA Expense

Medicare Expense

FUTA Expense

SUI Expense

Workers' Comp Expense

Additional Burden Expense

The AR Payment Journal contains the following (where the payment date of the transaction is within the date range selected):

Total Payment amount for each posted AR Payment.

The Payroll Journal contains the following (where the Check date of the transaction is within the date range selected):

Total Pay amount from each updated Payroll Check.

Total Pay amount from each updated Direct Deposit Advice.

Total Pay amount from each Posted Payroll Adjustment.

Total Pay amount from each Posted Void.

NOTE: The transaction post date for a direct deposit advice may be the date the advice was updated (if the advice has not been extracted by the GL Export date) or the date the advice was extracted (if the advice has been extracted by the GL Export date).