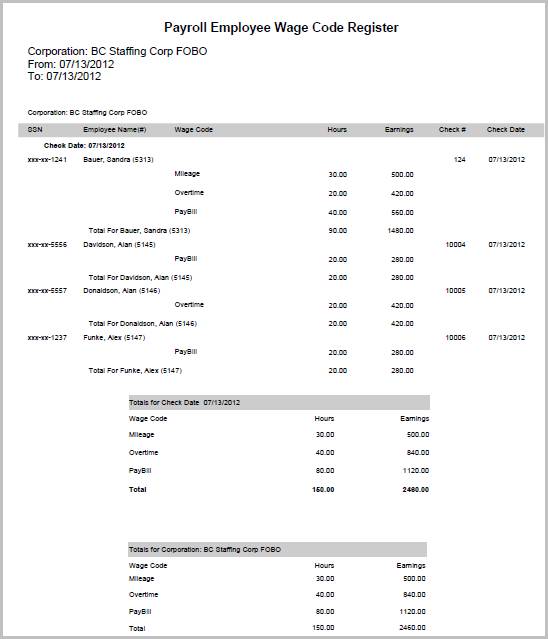

Payroll Employee Wage Code Register

The payroll employee wage code register lists the pay/bill codes by which an employee was paid during a specific payroll process. This report shows how earnings on a specific payroll were distributed. This report is available to systems with an active back office license and users with the payroll report permission. The report outputs records only for those Employee Branches to which the user has access.

1) Click Reporting on the main navigation bar and scroll to the Payroll Reports section.

2) Select Payroll Employee Wage Code Register to enter report criteria.

3) Select a Format type.

§ Process ID: (default format) the data is grouped by corporation then process ID and then sorted by process ID.

§ Check Date Range: the data is grouped by corporation then check date and then sorted by check date then check number.

§ Employee: the data is grouped by corporation then company and then sorted by employee then check date then check number.

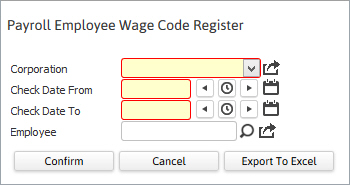

4) After selecting the format type the Payroll Employee Wage Code Register workflow will open for selection criteria input.

§ While updating the form, fields marked in red are required to complete the workflow. Click on the buttons to the right of certain fields to open a new window which will allow you to search and select options related to that specific field or choose a date.

§ Process ID criteria: opens to display attributes fields that are used to look up transaction records. The payroll process will be a check or direct deposit process with a status of completed.

§ Check Date Range criteria: corporation, date range and employee

§ Employee criteria: corporation, date range and employee

5) After entering the criteria click Run to generate the report.

§ Select export to excel to open the report as a csv file.

6) The report opens in a new window.

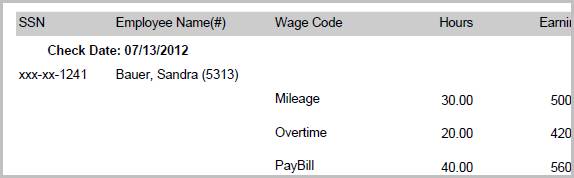

§ The header displays report name and criteria used to generate the report.

§ The data is then grouped and sorted by the format chosen in the beginning.

§ The paybill code detail lines from each check are listed.

7) Calculations in report:

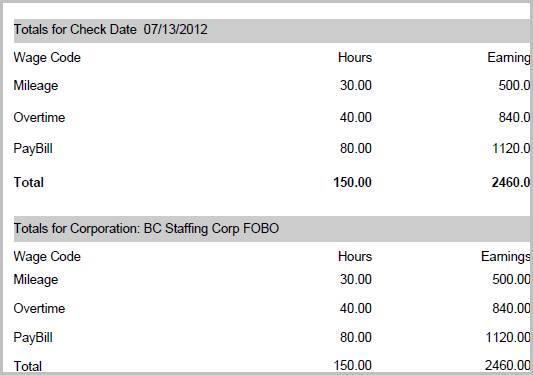

§ Total for Wage Codes, Hours, Earnings, for each check and corporation.

Full Report