Process Summary Diagnostic

Process Summary Diagnostic gathers together tax information for a corporation and reporting period in order to perform diagnostics and make the information available for the creation of a transmission file. This process must be successfully run for the corporation and reporting period before creating the transmission file.

1) From the Government Reporting Process Search Results page (accessed via Financials > General > Government Reporting), click Process Summary Diagnostic.

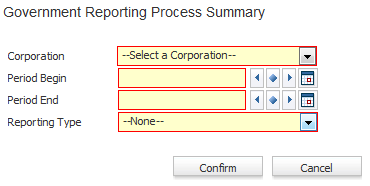

2) The Government Reporting Process Summary workflow opens in a new window.

§ While updating the form, fields marked in red are required to complete the workflow. Click on the buttons to the right of certain fields to open a new window which will allow you to search and select options related to that specific field or choose a date.

§ Select the Corporation on which you want to report.

§ The Period Begin and Period End dates are used for New Hire Reporting. The Period End date also determines the specific period reported. For example, if the Reporting Type is Annual, then the year in the Period End date field is used to determine the specific year reported. If the Reporting Type is Quarter, then the month in the Period End date field is used to determine the specific quarter reported.

§ The Reporting Type identifies whether you are creating summary information for a month, quarter or annual report. Use the droplist to select the reporting period you want.

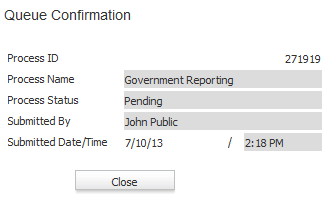

§ After entering the desired criteria click the Confirm button to send the batch to the queue for processing.

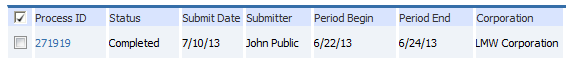

3) After the process is complete the list box is updated with a status.

§ If the status is anything other than completed, click on the Process ID to view diagnostics.

§ To see the type of process you ran, scroll to the right. The Process column identifies the type of report (Quarterly, Annual, etc.). The Process Type column identifies whether this was a summary diagnostic (Process Summary) or Transmission File (Extract).

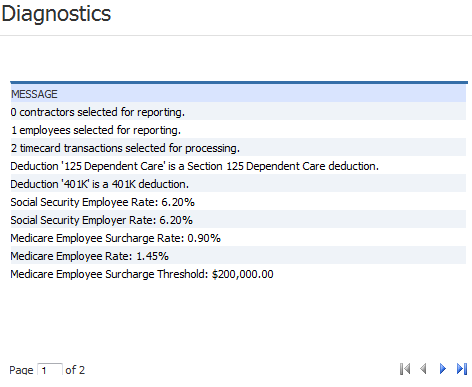

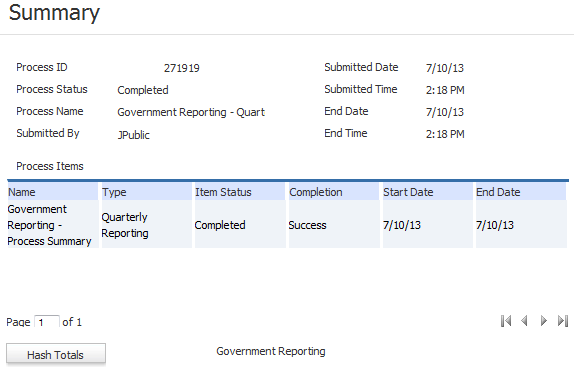

4) Clicking on the Process ID allows you to view details of the process.

5) Click the Diagnostics segment to view diagnostic information. This will explain why the process failed, if it did. For example, you may have forgotten to update payroll for some checks associated with the corporation. Or perhaps the system needs you to update information on a locality for which it needs to report. Even if the process did not fail, the diagnostics can provide general information about rates used and how deductions were reported.