Update Payroll

The update payroll workflow is the last step in the payroll and direct deposit process that finalizes batches included in the processing runs. Prior to completing this step, the transactions contained in the processing runs can be reset and/or recalculated. Updating also prevents any further re-processing of the batches already processed. This protects from accidentally running checks twice for the same batch. It also creates history records for all employees who have been paid. In addition, checks must be updated before they can be voided.

In addition, if the Employee is Work Opportunity Tax Credit (WOTC) eligible, the system creates a WOTC Payroll File after the update is completed. Once the file is completed, it can be downloaded via the File Retrieval option. The file is named "WOTC_PAY_YYYYMMDD_CorpName" (where CorpName is the Corporation Name). For more information on the layout of the WOTC Payroll File, click here.

Note: The auto generation of WOTC file with the payroll update process is a default setting which can be disabled by unchecking the Auto-generate WOTC File with Payroll Update checkbox in the System Settings screen (Administration > General Administration > Manage System Settings > Integration Settings segment).

Note: Only a single Payroll related process (Payroll Process, Direct Deposit, DD Extract, Reset Payroll, Reset Direct Deposit, Reset Extract and Update) per Corporation may run at any single time.

-

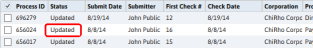

Select the processes to update from the listbox on the Payroll Process segment. In order to update a process, it must have a status of Completed and a Process Type of Paycheck or Direct Deposit. If you do not make a selection, the system will update ALL paycheck and direct deposit processes with a status of completed.

- Select Update Payroll from the Activities drop-list.

-

Clicking confirm will complete the workflow and send the selected processes to the queue for processing.

-

After the process is complete the process status is updated.