ACA Details

Operations > Employee > Information > Basic Information

|

ACA Details Operations > Employee > Information > Basic Information |

![]()

ACA Details is accessed by clicking the ACA Details button on the Employee Basic window. This displays the ACA Details Grid and allows you to view information about the Employee's hours, eligibility and coverage for the Affordable Care Act.

For more information about the types of ACA Employees, click here.

NOTE: The information in the grid and on the Employee ACA Details window is updated when you run the ACA Update process in PayBill.

The grid contains the following information. Different corporations appear on different rows. Note: The (T) or (C) indicate whether the information comes from the Current (C) or Trending (T) record. Current records represent the Employee's current ACA status. Trending records help predict who will need to be offered insurance in the future once the measurement period is over. It also helps determine who needs to be offered insurance and who has not yet returned their acceptance or decline forms during the administration period..

Last Updated: The last time the ACA Update process was run for this employee and corporation.

Corporation: The corporation the Employee worked for and to which the details apply. If "<Combined Corporations>" was selected during the ACA Update Process, this field will display "Combined Corps" indicating that the corporations on employees with multiple corporation records were combined during the Update process.

ACA Classification (T): Classification used to determine eligibility requirements for healthcare. Options are Variable, Non-variable, Part Time and Seasonal.

Coverage Status (C): The coverage status of the Employee for this Corporation.

Eligibility Status (C): The healthcare eligibility status of the Employee for this Corporation.

Eligible Hours (T): The sum of the Employee's hours accumulated from designated PayBill Codes for the Corporation.

Next Evaluation Date (T): This is the next date upon which you must decide whether to offer the employee health insurance or not.

There are two workflow options that can be selected from the ACA Details grid.

Cancel: This closes the grid.

View: By selecting one of the ACA Details rows on the grid and clicking View, you can see more details on the Employee (see next section).

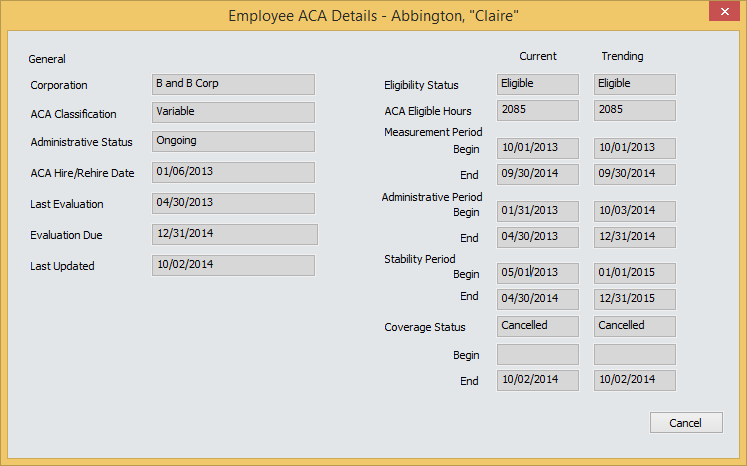

The Employee ACA Details window is accessed by selecting a record on the ACA Details grid and clicking the View button.

Note: All of the fields on this window are for information only and cannot be edited.

The window has the following fields:

Corporation: The corporation the Employee worked for and to which the details apply. If "<Combined Corporations>" was selected during the ACA Update Process, this field will display "Combined Corps" indicating that the corporations on employees with multiple corporation records were combined during the Update process.

ACA Classification: Classification used to determine eligibility requirements for healthcare. Options are Variable, Non-variable, Part Time and Seasonal. This is set in the Employee Payroll Tax Record. NOTE: If the Corporation displays "Combined Corps", the classification comes from the Corporation of the most recently posted timesheet. If multiple corporations have the same most recent timesheet work week-ending date then the highest Timesheet ID is used.

Administrative Status: Indicates whether the Employee is considered New or Ongoing for Administrative purposes. A new employee is one that has not been employed for a Measurement Period AND either cannot be reasonably determined as full-time at the date of hire OR has had a break in service. An ongoing employee is one that has been employed for a complete Measurement Period AND has not had a break in service.

ACA Hire/Rehire Date: The Employee's first assignment start date adjusted based on ACA regulations or the Employee timesheet's work week ending date after a break in service (again, adjusted based on ACA regulations).

Last Evaluation: Matches the Current Administrative Period End date. This is the date upon which you must offer the employee health insurance if they are eligible.

Evaluation Due: Matches the Trending Administrative Period End date. This is the next date upon which you must decide whether to offer the employee health insurance or not.

Last Updated: The date the information in this Employee ACA Details record for the Corporation was last updated.

Eligibility Status: Healthcare eligibility status of the Employee for the Corporation. This status is based upon Eligibility Hours and/or placement on a long term assignment. The options are Eligible and Not Eligible.

ACA Eligible Hours: Number of hours worked by the Employee in the indicated measurement period.

Measurement Period: This is the look back period where hours are calculated to determine if variable employees worked full-time. For more information about how these totals are calculated, click here.

Administrative Period: This is the period of enrollment. It is during this time that you need to determine who is eligible, inform the employee of their insurance options and retrieve the forms from the employee either accepting or declining insurance. For more information about how these totals are calculated, click here.

Stability Period: This is the period of time that the employee is either eligible or not eligible for insurance based on the measurement periods. For more information about how these totals are calculated, click here.

Coverage Status: Indicates the latest healthcare action (Offer, Accept, Decline, Cancel) taken on the employee record. If the Coverage Status is Cancelled, the Begin Date shows when the coverage was last Accepted and the End Date shows when the coverage was last cancelled. If the Coverage Status is Accepted, the Begin Date shows when the coverage was last Accepted.

To close the window, click Cancel.

![]()

Related Topics:

|

|

|

|

|

|